Archive for June, 2018

Thoughts on Day 3 of Money 2020, Europe

Posted by sseely in Uncategorized on June 6, 2018

Walking the show floor at Money 2020, one sees lots of payment providers. Its no shock then that today, I saw a lot of talks on how this works. This is in keeping with the theme of the show: the future of money. The previous two days, I did hear a fair amount of talk about moving away from paper money, what to do about fiat currency vs. other currency, and difficulty in managing payments. Today, we heard about what is possible with payments.

The facts keep stacking up around us about people preferring to pay electronically instead of with plastic or currency. Those electronic payments are happening in apps:

The first three are as phone OS capabilities, the last two are via apps on the phones. Electronic payments make a number of things better for consumers, retailers, and credit institutions (banks, credit card companies, etc.). For consumers, they get convenience. For retailers, they find less friction at checkout. For credit institutions, they get reduced fraud. So far, so good, right? Well, what I learned after this was a lot more interesting: if you are just reducing payment friction, you are leaving a lot of opportunity on the table. Opportunity for:

- Learning about the customer. You are collecting their buying habits. Imagine what you could do if you did more to help, what else could you learn?

- Getting retailers to use your payment system. You know a lot about your customers and what they like to buy. You can now refer them to other retailers, services, and so on. Use that to convince retailers that if they use your system, you will drive more interested customers their way.

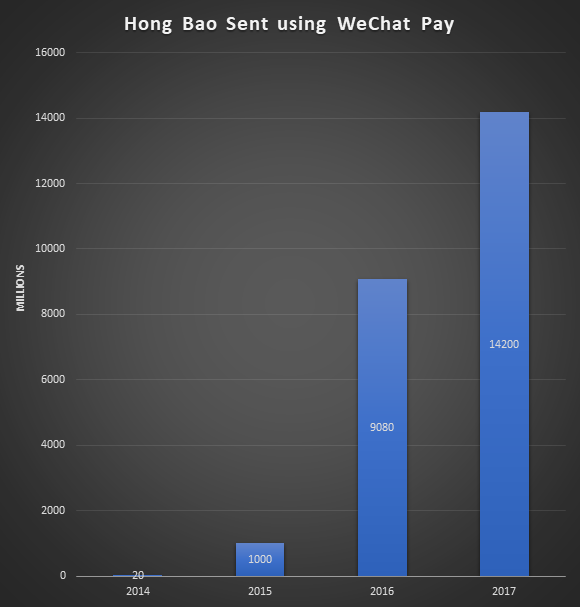

- Delight your customers in novel ways. WeChat has delighted their Chinese users by making it easier to send Hong Bao (a monetary gift in a red envelope) to others. Their users love this feature. Here’s what the growth has looked like year over year (numbers are from a presentation by Ashley Guo of WeChat):

You can also look at Ant Financial/Alipay. Despite their name, they are not a payment company; they are a marketing company. You use them to schedule doctor appointments, figure out how to travel on public transportation or taxi, manage vacations, discover information about products, and so on. And yes, when the service is performed or goods are purchased, they also make sure that the vendor is compensated by you. But, they make it all seamless. The product has been successful in China, turning their tier 1 and tier 2 cities into cashless areas. The services are so popular with their Chinese user base that the apps are used around the world at high end retailers down to businesses like Burger King.

Both WeChat and Alipay emphasized that they use the data to better market to users. The users like the targeting in their lives. When traveling, they discover attractions and restaurants that appeal to them because the app knows them so well. The businesses are happy to participate because they acquire customers who may not have found them otherwise.

What I saw today was a lot of companies thinking about how to make transactions easier by working with banks and credit card companies to remove plastic from your life. This is great. I look forward to the day when my wallet no longer bulges because of all the cards I need to carry.

I also saw something wonderful and scary: a world where things will generally improve for me if I let artificial intelligence and machine learning see all the things I do. By knowing what I eat, where I go, and so on maybe the algorithms can warn me to start doing some things (walk more) and stop doing other things (keep it to two coffees a day). Scary, because I worry what would happen if all that data was combined in some nefarious way. For example, if the algorithm senses that I get out of depression by spending money, maybe the algorithm seizes on this by getting my spending up using knowledge sales people only wish they knew. Or, me being denied a job because the data leaks that I buy [something the employer wants to look out for: alcohol, cigarettes, etc.].

In all, a very interesting day around payments.

Thoughts on Day 2 of Money 2020, Europe

Posted by sseely in Uncategorized on June 5, 2018

The conference at Money2020 has many tracks. Given the amount of questions I have seen from customers around distributed ledger technology (DLT) (Blockchain, Hyperledger Fabric, Ethereum, Corda, etc.), I attended that track. In the track, there were a fair number of panels staffed by either users of DLT, consortiums looking to make their use cases more ubiquitous, and implementers of DLT. While all groups had different lenses on what is going on, they tended to agree on what problems DLT solves and how to use the technology.

For finance, DLT helps eliminate a lot of verification/validation work with happens in the middle and back office.

This has been framed as the “Do you see what I see?” (DYSWIS diss-wiss) problem. DYSWIS solution attempts from the past have involved things like cryptographic signatures where two parties compare signatures of the data. Those solutions fail for the main reason crypto comparison always fails: normalization of data prior to signing. DLT solutions solve this in different ways, but they all have ways to sign facts and achieve consensus about the facts.

Anyhow, back to the main point about saving time confirming that what I see matches what you see. The finance industry has used a strong central authority for smaller, contract-less transactions in the form of Visa, Mastercard, and others. Then, we get to more complex transactions. How complex? Consider this scenario:

A European importer purchases some goods from an East African exporter. The importer prefers to pay when goods arrive. The exporter prefers to be paid when goods are shipped. Neither gets their preferred mode because of risk. The bank for the importer needs to issue a letter of credit. The exporter also insures the goods until delivery. The shipper, sitting between importer and exporter, will orchestrate the movement of the goods through several partners, who in turn may use other partners. Finally, the exporter will insure the goods in case of loss. It is normal for the shipment to pass through around 30 entities and have around 200 transactions [info from a presentation by TradeIX.com].

How does DLT help here? Using DLT, the importer, exporter, bank, shipper, and insurers can all see what is happening in real time (within minutes). Because facts are attested to and sent digitally, human transcription errors disappear. This means that humans may only to verify that the numbers and such look “right” before allowing their end of a transaction to proceed. This frees up human capital to do more valuable tasks.

So, one question you might ask yourself is “which DLT is right for me?” More than a few of the C-level folks on panels said a variant of “I don’t care. I just want something that works.” For those of you that care about the details and optimal choices, understand this: if you are joining a DLT consortium and it doesn’t use what you consider to be best, you need to just build something that works with the choice. If you complicate things by creating translation layers between something like Corda and Ethereum, expect to be looking for a new job tomorrow (because you’ve been fired).

The great news here is that the businesses now understand how to apply DLT. They have found that their normal transaction volumes of 200 TPS are already handled by most enterprise DLT solutions. They also understand the difference between on-chain and off-chain data, so don’t put PII and other GDPR prohibited data on the chain.

Over and over again, I heard the C-level folks say “I want DLT for the use cases where I spend a lot of time verifying that data was input correctly because that work costs too much time and slows down the business.” Then, using those facts, they want to drive cost savings elsewhere. The instant verification of the truth reduces financial risk. The reduced financial risk means the business can now make decisions sooner to further improve their ability to move money, settle accounts, and so on.

In 2018 you will hear a number of implementations of DLT in a number of markets. At this time, it seems prudent to be familiar with the leading contenders in the space. At the moment, these seem to be (in no particular order):

This will be an exciting year for DLT.

Thoughts on Day 1 of Money2020, Europe

Posted by sseely in Uncategorized on June 4, 2018

I just finished day 1 of Money 20/20 Europe. I stuck mainly to the large sessions and to the show floor. What I saw was a repeated vision of what this group in finance sees as the next set of important things to be tackled. Everything they are doing revolves around the customer and making things better for customers. Depending on where you are in the financial ecosystem determines which pieces you are building and which pieces you are integrating.

From the banking side, we heard from many folks. I took the most notes from the talks by Ralph Hamers (CEO of ING Group) and Andy Maguire (Group COO at HSBC). After these two, the themes repeated which only solidified that they weren’t unique in their visions. Because banks already have the balance sheets and other nuts and bolts of building a banking business, their vision is to provide a banking platform that other businesses can plug into. Any workable platform must be open: competitors need to be able to plug into it just as easily as partners. This will allow the bank to stay good at what it knows while letting other partners fill the gaps with the wide variety of expertise that the bank does not have so that it can participate in new opportunities more easily. For example, many banks are finding success by going into geographies where their customers only interact with them over a digital experience: no human to human interaction over 99% of the time. To do this, they craft their platform and their onboarding experience to be as easy to use as possible. Several banks talked of doing work to reduce the integration times with their platforms from months down to weeks. These efforts are paying off to allow the banks to find ways to interact with more customers in more countries.

From the FinTech side of the house (which for this conference so far is the “everyone else” even though I know this leaves out personal finance folks), I saw a lot of interesting technology. A lot of the technology focused on a few areas, all with interesting takes on how to accomplish the goals. I saw a lot of distributed ledger technology (aka blockchain) with implementations that have already gone live. It wasn’t clear to me how blockchain is being leveraged, but tomorrow promises to have a number of talks around the “what” and “how”. The show also has a number of folks presenting different ways to present your identity. Many of these still focus around the two factors for authenticating and many are avoiding passwords, PIN codes, and the like. The primary mechanism here is:

- Some biometric. Two most commonly cited are fingerprint and face.

- Smart phone.

So, yes, the argument that goes “What about people from [some part of world that they think doesn’t have Android or Apple phones]?” is not under consideration. In the countries where the banks operate, they know that most of their customers have smart phones.

The final thing I noticed is that AI came up a bunch and it was all nebulous to the speakers. Asking some of the AI firms on the floor, the sales folks know that they have data scientists and those people build and maintain their models. AI/ML is being applied to Know Your Customer/Anti-money Laundering work as well as fraud detection. Given the sales process, my guess here is that the people who need the tech will talk to those who make it and then have their engineers have the nitty gritty discussions of integration. I’m definitely looking forward to learning more there.

I also spent a bit of time on the show floor. Because it’s banking, a lot of the vendors create solutions that run in the client data center OR the cloud. For those folks, I’d like to let you know that you should look at joining the Azure Marketplace. This can give you ease of deployment for your customers who run in Azure and is fairly handy for VM only deployments. Contact me and I can help you get on board.

You must be logged in to post a comment.